The Home Loan Process

Demystifying Home Loans

If you haven’t experienced it before, the home loan process can feel overwhelming, but I will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, I partner with some of the best lenders in the industry, and am happy to introduce you, so you’ll be taken care of.

finance with

Guild Mortgage

Jason Gosser

NMLS ID # 120413

- 425-330-1314

- 2915 Hewitt Ave Everett WA 98201

A western Washington native, I have been a mortgage loan officer in the Seattle metro area for over twenty years. Though this experience has given me a wealth of knowledge in home loans, my ability to listen to my borrowers and understand their priorities is what really gives me the insight to find the best mortgage loan program to meet their needs. I specialize in loans for first time home buyers, government mortgage programs, and zero down loan programs. My team is dedicated to providing first class customer service to everyone we have the opportunity to help.

Let's Get Started

Dwell Mortgage

Shane Kidwell

NMLS ID #: 200950

- 425 595-3164

- 2817 Wetmore Ave, Everett, WA 98201

The dwell Mortgage story began in 2010 when founder Shane Kidwell hurt his back at his dream job working as a fireman. After battling several more back injuries he had to ask himself what was next? Raised by an entrepreneurial dad (one of the founders of Horizon Air) and a hard working mom (She raised Shane and his brother after his dad lost a battle with cancer); Shane always had the desire to continue a legacy of hard work, creative thinking, and living by contribution.

Having matured his work ethic and core values from his time working at the busiest fire station on the West Coast, Shane was ready to invest in himself (give his back a rest) and go all in on being an entrepreneur. As most do in the mortgage industry his route wasn’t planned. But after “dabbling” part-time while also being a full time fireman, Shane saw an opportunity to bless others (and be successful) and retired early from the Seattle Fire DepartmentAfter years working for others, Shane felt it was time to shift and create a unique brand and culture that went against the status quo and reflected his core values and blue collar roots.

“Work Hard, be successful, but don’t do it on the backs of others. ” was his mindset. As he looked at the Mortgage Industry he saw a gap and he asked himself “how can we be better, how can we be different”? Thus began dwell Mortgage. (Yes we know it’s a lower case D, we like being different!)

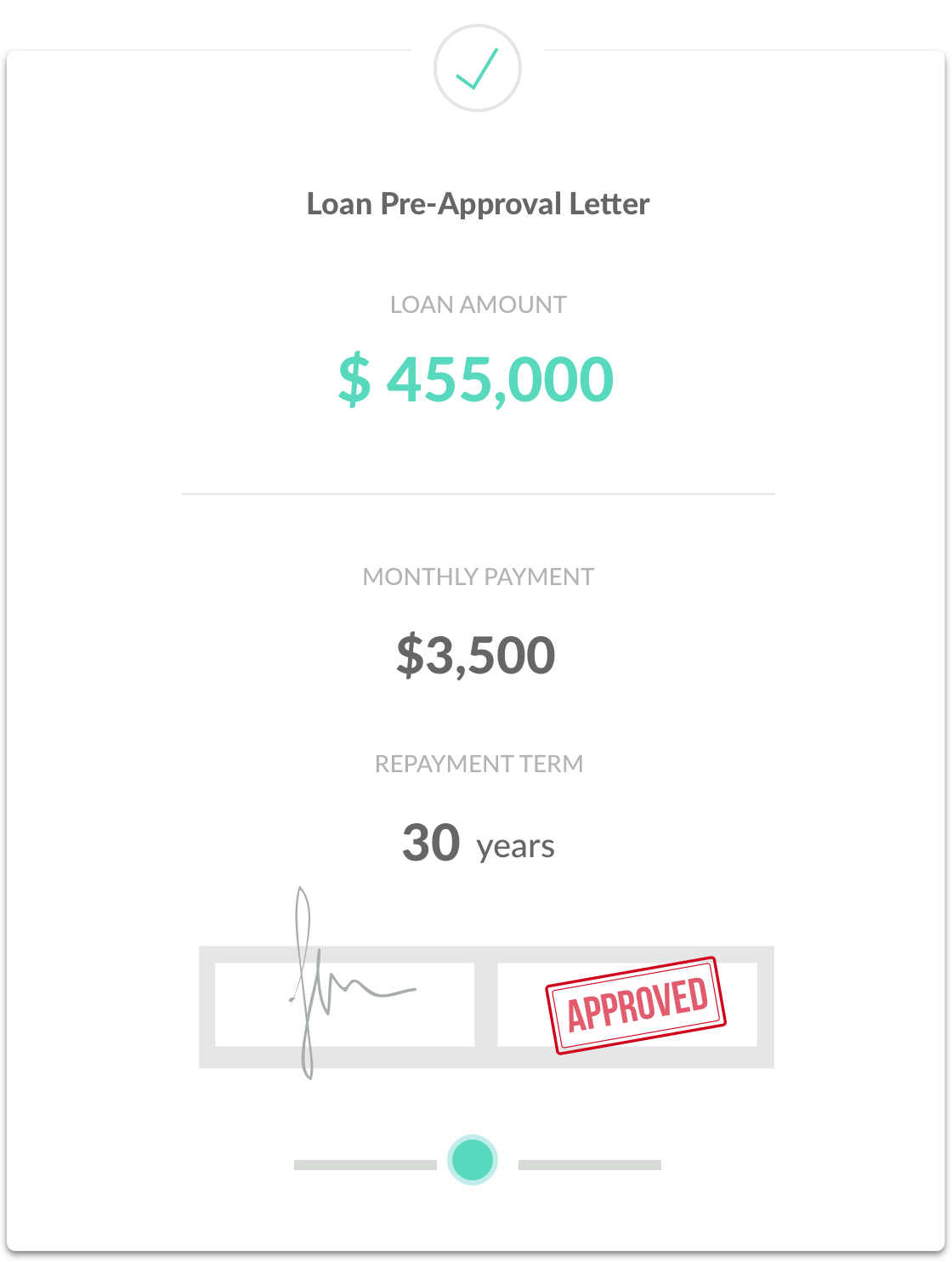

Get Pre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Helping You Get The Best Loan

Start The Process

I’ll help you find the best local loan officer to get you competitive rates and the programs that best fit your individual needs. Fill out this form and I’ll connect you with a lender today!

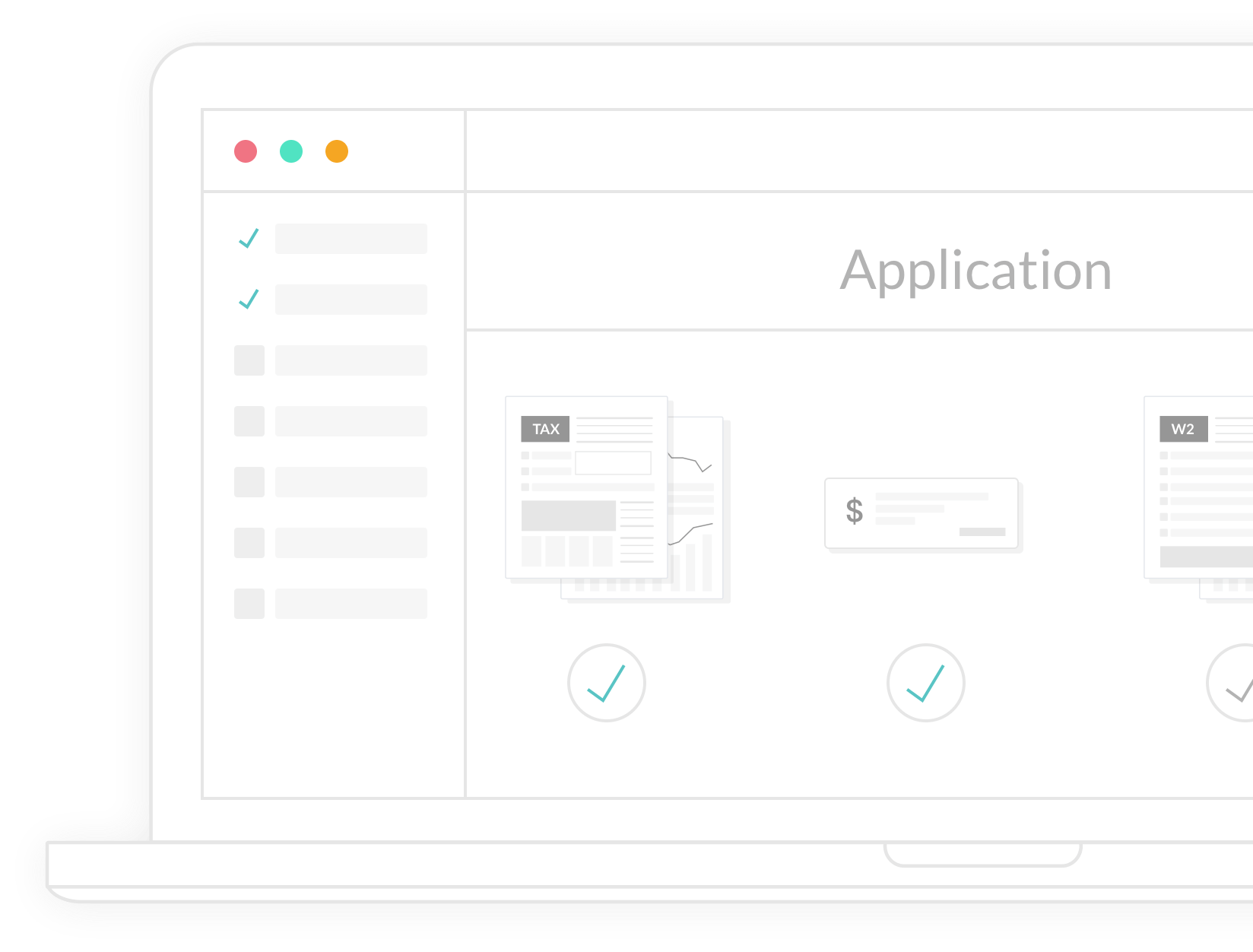

Application & Processing

What happens when a loan goes "live"

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Closing

Signing and Finalizing the deal

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Congratulations, happy homeowner!